ABOUT US

Prattco Creekway Industrial (PCI) was launched in 2016 to acquire and manage Class A and B Light Industrial buildings in Texas and surrounding Sunbelt States. The targeted submarkets have a strong tenant demand in areas with increasing population and job growth presenting robust demand for tenants. PCI brings a strong history of leasing, operating and institutional knowledge. With long-time veterans of Lincoln Property Company and GE Real Estate, the partners have over 100+ years of real estate experience both domestically and globally. PCI brings an institutional quality investment and management platform with a core competency in value creation, capital preservation and risk management. The partners of PCI have broad and deep experience in industrial acquisitions, management, leasing and operations.

1.8MM SF

IN CURRENT

PORTFOLIO

20MM+SF

INDUSTRIAL ASSETS

MANAGED

12

OFF MARKET

ACQUISITIONS

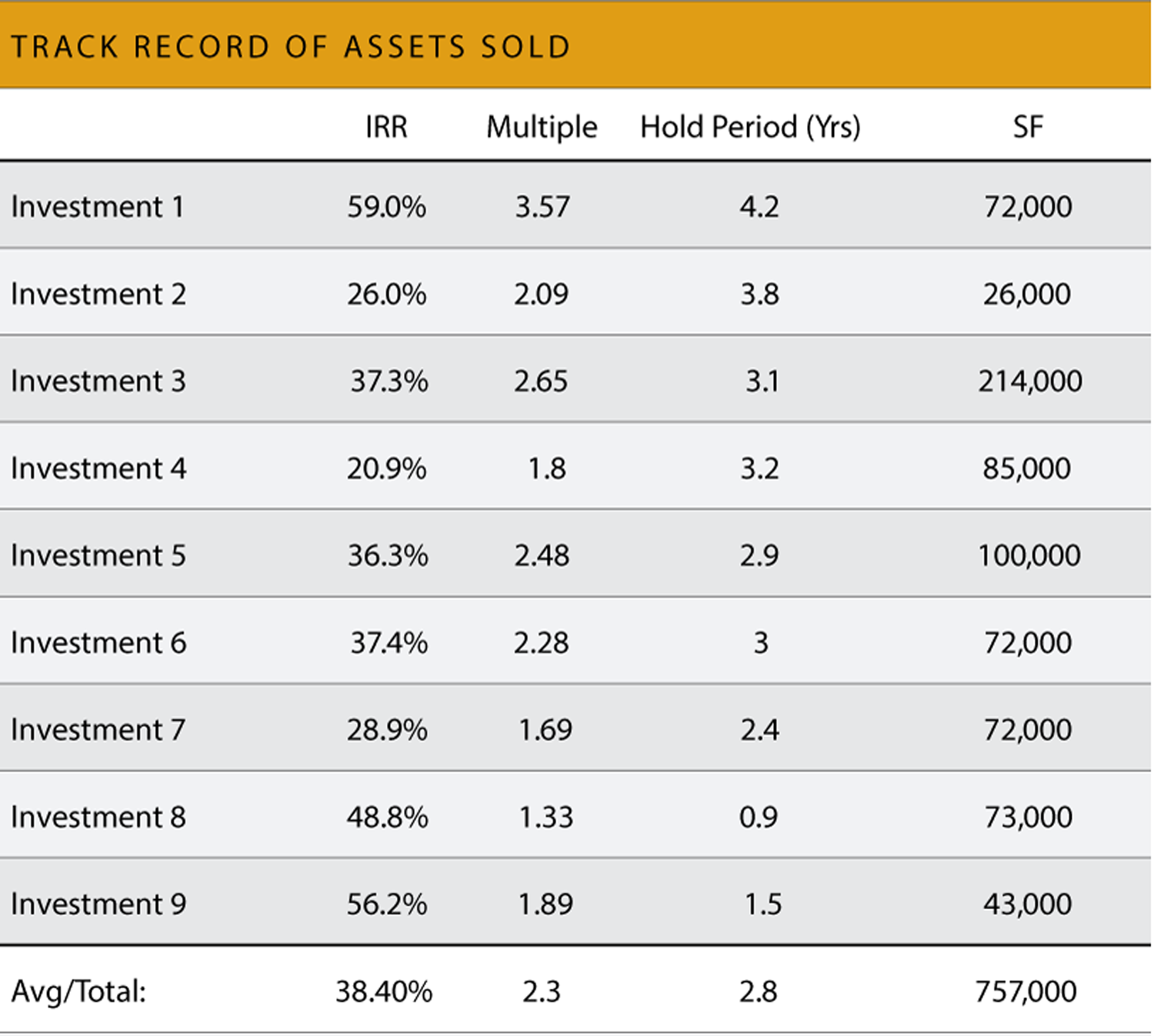

2.30X

AVERAGE EQUITY

MULTIPLE

38.4%

AVERAGE IRR

TRACK RECORD

INVESTMENT ATTRIBUTES:

- Seek vacancy or buildings with below market rent

- Strong Cash Flow; Purchase stabilized properties in mature submarkets

- Preservation of Capital – High tenant retention and strong owner user pool

- Resilient to Commercial RE Market Volatility – Product producing tenants non-financial)

- Strong risk adjusted overall equity return

- Proven market disconnect for individual buildings. Inefficiency of the capital markets for a large portion of the product type, particularly Light Industrial

FLIGHT TO QUALITY

During times of uncertainty or disruption in the market, with higher cost of capital for longer, and margins that have narrowed and less pursuit of speculative deals, quality assets are important. But quality people are the priority. Investing in capable, qualified, and battle tested people like PCI’s partners is the differentiator.

GLOBAL VIEW

Investing in partners who have had decades of experience globally and domestically brings a unique and valuable perspective to the partnership. PCI’s partners have extensive experience working within the U.S., Berlin, Central Europe, North & South America, Mexico, Argentina, and multiple other locations in Europe.

REAL ESTATE VETERANS

The partners have over 100+ years of combined real estate experience in investment, development, management, and much more.

» Prior to the formation of PCI, Lance Bozman (Co-Founder) resided in Berlin and Budapest and was a Managing Director for AIG/Lincoln, a European partnership between American International Group Global Real Estate and Lincoln Property Company. Additionally, Lance was an exclusive real estate representative throughout North and South America for EDS, an international technology company.

» Chad Lunsford (Co-Founder) has over 29 years’ experience in commercial real estate encompassing more than $1.3B of acquisitions throughout the United States, Mexico and Europe. During Chad’s 20+ years at GE Real Estate, he was Senior Director, Risk Management and Underwriting for the U.S. and Mexico and was also the Valuation Leader for the $3B European

platform.

» Blake Bozman founded 9 start-up or distressed companies successfully growing and monetizing them once operations/growth were optimized and value had been realized. The companies range from real estate, trucking, technology, footwear, banking and golf-course development. Blake has consulted with an auto finance company in Argentina, collaborating with the Central Bank,

Deloitte, Worcap and others to create an origination model and funding process.

» Rebecca Tatsch has more than 20 years of experience in commercial property management and project management. She began her real-estate career working for Trammell Crow Company managing industrial properties on behalf of institutional owners and advanced quickly into the management of office, retail and historic buildings while filling leadership roles at CBRE, Stream Realty Partners, Transwestern, and CASE Commercial Real Estate

INSTITUTIONAL EXPERIENCE & MINDSET

Equity should seek real estate veterans that are institutionally minded, experienced executives, specifically in risk management, ROE focus, and capital management. PCI has earned this label, based on their partners’ track records, and reflects this in their primary focuses:

» Preservation and equity return priority with careful, conservative, and detailed underwriting experience.

» Value add/value creation which has produced profits through several cycles in challenging environments.

» Capital management/income stream continuity with a history of monetizing companies in a variety of industries.

» Heavy emphasis and skill set within property management with tenant relations/retentions, asset management, equity reporting indicating security of investment.

» Treating all partners’ funds like PCI’s own funds.

LONG-TERM, SYNERGISTIC PARTNERSHIP

PCI’s goal is to find an investor to recapitalize the subject portfolio, and ideally this partnership would continue pursuing future acquisition opportunities as well. PCI’s team, relative to other groups seeking capital, stands above the rest in terms of experience, economic resilience, and partnership collaboration. PCI’s dynamic team, in addition to their track record, makes them a valuable partner during market high and low cycles.

OUR MANAGEMENT TEAM

Lance Bozman

Managing Partner

Lance is the Managing Partner and Co-Founder of Prattco Creekway Industrial (PCI), where he is responsible for overseeing strategic investments and overall business operations.

Lance has more than 38 years of experience in real estate investment, development, and management.

Prior to the formation of PCI, Lance resided in Berlin and Budapest and was a Managing Director for AIG/Lincoln, a European partnership between American International Group Global Real Estate and Lincoln Property Company. He developed office, retail, and industrial assets across multiple countries averaging an IRR return of 50%.

Previously, Lance was an exclusive real estate representative throughout North and South America for EDS, an international technology company. He began his career leasing industrial properties for Lincoln Property Company.

Lance earned a BBA in Finance at Southern Methodist University. He serves, or has served, on the Board for Folsom Institute for Real Estate SMU Cox School of Business, Broadway Dallas (formerly Dallas Summer Musicals), Campus Crusade Hungary, and SMU Alumni. Lance lives in Dallas with his wife Eszter, daughter Sophie, and son Benjamin.

Chad Lunsford

Managing Partner

Chad is the Co-Founder of Prattco Creekway Industrial (PCI). He leads in the daily operations, acquisitions and capital market. Chad has over 29 years’ experience in commercial real estate encompassing more than $1.3B of acquisitions throughout the United States, Mexico and Europe. Chad has deep domain knowledge of Industrial, Multifamily and Office product types.

Prior to founding Prattco Creekway, Mr. Lunsford was with GE Real Estate for over 20 years. Prior to his departure, Mr. Lunsford was Senior Director, Risk Management and Underwriting for the US and Mexico. He was also the Valuation Leader for the $3B European platform.

Chad earned his BBA Finance from the University of Texas at Austin and MBA from Southern Methodist University where he graduated with Honors. He is active at Prestonwood Baptist Church and serves on the Board of Directors for Prestonwood Christian Academy.

Blake Bozman

Managing Partner

Blake is a Co-Founder of Prattco Creekway Industrial primarily leading in capital markets and portfolio leasing activity.

He was a Founding Partner of Drive Financial and Executive President of Sales. What began as a start-up, he grew sales to $2B in auto loans before selling the company to Banko Santander.

Blake has founded 9 start-up or distressed companies successfully growing and monetizing them once operations/growth were optimized and value had been realized. The companies range from real estate, trucking, technology, footwear, banking and golf course development. He started Prattco International (family office) with his brother and dad which focused on private equity real estate investments and oil and gas properties. Blake has consulted with an auto finance company in Argentina, collaborating with the Central Bank, Deloitte, Worcap and others to create an origination model and funding process.

Blake received his B.A. in Marketing from Southern Methodist University. He serves on the Board of Veritex Holdings, West Dallas Christian School and Art House Dallas. Blake is an active member at Watermark Church. He lives in Dallas with his wife Tara and three children Ryan, Landrie and Cannon.

Rebecca Tatsch, CPM, RPA

Managing Director, Prattco Creekway Management

Rebecca Tatsch has more than 20 years of experience in commercial property management and project management. She began her real-estate career working for Trammell Crow Company managing industrial properties on behalf of institutional owners and advanced quickly into the management of office, retail and historic buildings while filling leadership roles at CBRE, Stream Realty Partners, Transwestern, and CASE Commercial Real Estate.

Her areas of expertise include all aspects of property and asset management, tenant retention, acquisition, disposition, due diligence, and construction management in Class AA/A office, historic/landmark, industrial, and retail properties on behalf of a variety of ownership entities including private equity funds, pension funds, life companies, REITs, TICs, and private non-institutional owners.

She holds an RPA designation from the Building Owners and Managers Association, a CPM designation from the Institute of Real Estate Management, is a Licensed Texas Real Estate Salesperson, and attended Rasmussen Business College.

Sam Strickland

Director – Acquisitions

Sam, a Dallas native, graduated from Texas Christian University in 2015. Prior to joining PCI, Sam worked for two large Commercial Real Estate brokerage companies in Atlanta, Georgia – CBRE and Colliers. Sam joined CBRE as an analyst for the overall office platform serving tenant reps, landlord reps and the institutional investment sales team. Following, he transitioned onto CBRE’s National Net Lease Property Group’s investment sales team where he played an integral role in the team’s valuation, underwriting, financial analysis, and marketing efforts transacting $2B worth of product in 2018. After three years at CBRE, Sam transitioned to the office leasing team at Colliers. Sam assumed key transaction responsibilities for two national and global clients executing 230,000 square feet of total transaction volume. During his 5-year residency in Atlanta, Sam gained valuable experience and knowledge working for top producers within the country. Sam brings a capital markets, leasing and analytical background to PCI and is currently assisting in the expansion of PCI’s industrial portfolio in primary/secondary markets within the Southwest region.

Sam earned his degree in Economics from Texas Christian University and currently lives in Dallas with his wife, Catherine, where they both are active at Highland Park Presbyterian Church.

Trisha McGilvery

Office Manager/Property Manager

Trisha McGilvery has over 10 years of experience in commercial property management and project management. She began her real-estate career working for CASE Commercial Real Estate as an assistant property manager managing mid-rise office and industrial properties. She advanced quickly into the property management role at Colliers International and received the Property Manager of the Year Award.

Her areas of expertise include all aspects of property management, tenant retention, acquisition, disposition, due diligence, and construction management in office, industrial, and retail properties on behalf of a variety of ownership entities. She also has vast knowledge in commercial construction and development, as well as starting up property management divisions.

Trisha is originally from Vancouver Island, Canada, and enjoys spending time with her grandchildren and being on the open water.